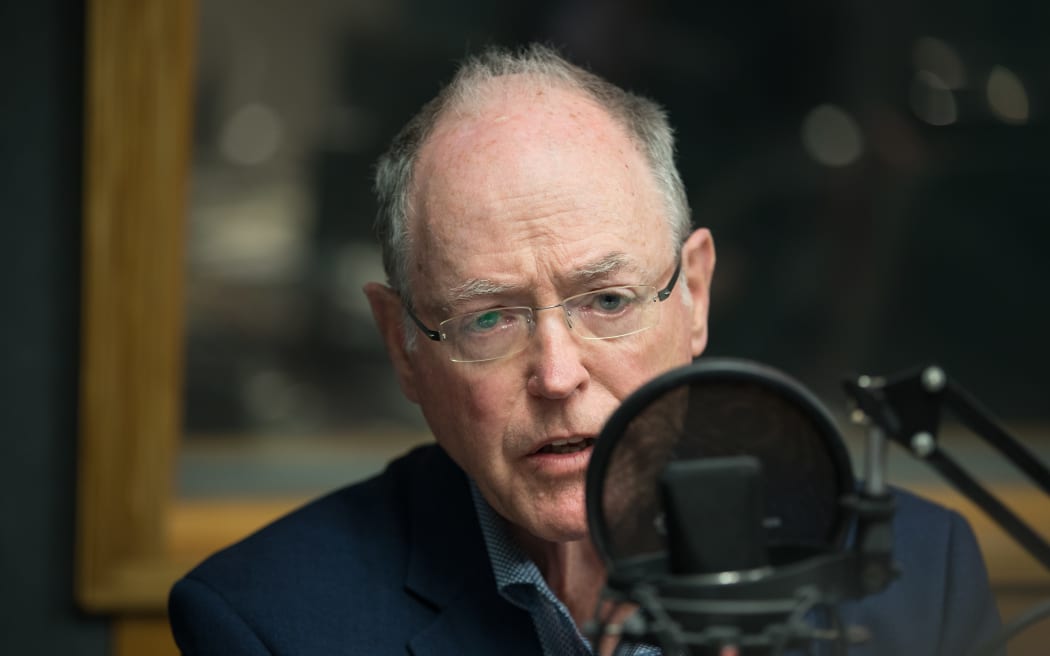

Prime Minister Chris Hipkins announces Labour's tax policy ahead of the 2023 general election, in Lower Hutt on 13 August, 2023. Photo: RNZ / Angus Dreaver

Labour's GST-free fruit and vegetables tax policy is being widely panned by experts, who say it is betting on voters' ignorance.

Announced on Sunday, the policy would see GST removed from unprocessed fresh and frozen fruit and vegetables, alongside a boost for Working for Families.

Asked if he could name an economist or tax specialist who supported the GST change, leader Chris Hipkins came up short - so RNZ has approached a dozen and sought their views on the matter.

Lisa Marriott

Associate professor of taxation at Victoria University, Lisa Marriott Photo: Supplied

"I hope it doesn't see the light of day," Victoria University professor of Taxation Lisa Marriott said. "To be perfectly honest, I think it's one of the worst ideas I've heard for a while.

"It's really unlikely that all that saving will be passed through to consumers. And because it's on products like fruit and vegetables that do fluctuate there's going to be no way to hold supermarkets to account on this.

"The other main thing is the integrity of the tax system: we have a really good GST system precisely because we don't have all these exclusions that other countries have. And I now see that this is being used as justification, and we're being called 'an outlier' however, I think pretty much every other country in the world would look to us and say that we have a system, which is far preferable.

"And I think once this cat is out of the bag ... it's probably something which would be difficult, if not impossible, to actually reverse."

Eric Crampton

Photo: supplied

"Creating holes in GST is a terrible idea. It only becomes appealing when a party is down in the polls," New Zealand Initiative chief economist Eric Crampton said.

"It's complicated, it's annoying, it adds an awful lot of cost to running a tax system, it makes everybody's tax returns more complicated... and it's all for nothing. It doesn't give you any benefit.

"It's a bet that voters are too stupid to understand tax policy. I hope that voters aren't.

"New Zealand is known as having one of the most clean consumption taxes that exists, it is not riddled with holes, and that means that it is able to collect an awful lot of money for the government at a relatively low tax rate... only Hungary collects about as much revenue out of its consumption tax relative to GDP as New Zealand does - and their consumption tax rate is 27 percent.

"Lots of things are possible. Not all of those things are a good idea."

Craig Renney

Council of Trade Unions (NZCTU) policy director and economist Craig Renney. Photo: Stuff / ROBERT KITCHIN

"It wouldn't be my first choice if we were going to do this, but it's definitely something that's worth exploring," Council of Trade Unions chief economist and director of policy Craig Renney - a former advisor to Finance Minister Grant Robertson - said.

"There are plenty of examples from overseas of lots of challenges that have been put in place in delivering these kinds of reforms... the extent to which that change is captured by supermarkets, or whether they end up being captured by consumers... so that's why they wouldn't be my first choice.

"There are more direct routes to put money in people's pockets.

"I would rather do this than do a tax change [like National's] which gives the majority of the change to higher income earners, that's a much more regressive approach... I would rather do this than remove the 39 percent rate on income tax, which is ACT's policy, for example."

Ranjana Gupta

AUT senior taxation lecturer Ranjana Gupta. Photo: Supplied / NZ Herald

"The rich people will get more benefit because they spend more," AUT senior taxation lecturer Ranjana Gupta said. "Inequity will increase because the benefit will go more in the pockets of rich people.

"Low income households will save only $2 per week and for them the saved money is more useful - and they will spend it to buy - say, clothes, or pay rent or buy meat or some other goods.

"And no doubt the sellers will start categorising the goods incorrectly and there will be fraud ... so the GST collection for IRD will be lesser and to investigate these types of frauds or inappropriate behaviour of the sellers it has to spend more on administrative [costs]."

Brad Olsen

Infometrics senior economist Brad Olsen. Photo: Supplied / James Gilberd Photospace

"If you can find an economist that supports this policy, they don't deserve the title," Infometrics principal economist Brad Olsen said.

"These are the sorts of policies that sound good on paper, do not deliver in reality, and are oversold... in reality, this is as much of a tax cut to millionaires as income tax relief would be.

"First, it's not targeted to people that need the support the most - in fact, it gives more dollar-for-dollar to those on higher incomes - and the government could well have given the lowest half of New Zealanders literal cash payments, and it would have been a more targeted policy. Secondly, it is complex to administer... And third is there's no guarantee that those cost savings are actually passed on to consumers."

Labour's claim the Grocery Commissioner could ensure the savings were passed on to the consumer did not stack up, he said.

"They cannot ensure that... the Tax Working Group itself said that they'd be lucky to get 30 percent pass-through coming through."

Don Brash

Photo: RNZ / Cole Eastham-Farrelly

"It's a sign of desperation," Don Brash, who chaired the committee which designed New Zealand's GST system, in 1985, and was later elected as leader of National and ACT, said.

"It is a politically opportune thing to do. I've been surprised at how many people I meet with who say, 'Yeah, why not? It sounds a good idea'. It is a really stupid idea.

"It's a very inefficient way of helping the people you most want to help - presumably, low income people. Most of the money spent on food and vegetables is spent by middle and high income people, so you give away a lot of revenue as a government for very little benefit to the people you most want to help.

"Why not also books and children's clothing and doctor's bills? There are a whole raft of things which you could justify as being exempt - in no time at all, you've got a Swiss cheese of a tax, having to push up the rate of of GST on everything else.

"Yes, lots of other countries do have exemptions - and lots of other countries, as a consequence, have much higher GST rates. The countries that do have exemptions, I suspect wish they didn't."

Terry Baucher

Terry Baucher Photo: Supplied

"It's an expensive option for little gain," Baucher Consulting head and tax specialist Terry Baucher said.

"There's no doubt it's popular. That's what their polling will tell them, but that's because people think it's going to have a greater benefit than it actually will have.

"I don't think taking GST off fresh fruit and veg solves the problem of people not having enough money. And also, where do you draw the line? Once you take it off fresh fruits and vegetables, what's to stop exempting other stuff?

"If you're going to do something of general application, then changing the tax rate thresholds, etc, maybe a tax-free threshold would achieve the same result but be more economically efficient ... not quite tax neutral but coherent from a tax policy perspective."

Paul Smith

"From a tax policy perspective, it is not a good idea," EY partner for GST Paul Smith said.

"Internationally, New Zealand's GST system has been held in the highest regard. It's known as one of the best GST systems in the world and that's because it is very simple. There are very few exemptions. It's broad based, and it's a highly efficient tax.

"Yes, other overseas countries exempt a variety of things, but the compliance cost in those overseas jurisdictions is way higher than the compliance cost is in New Zealand.

"If you have an exemption for food then it maybe starts to open up arguments about, 'well, why don't we introduce higher rates of GST for luxury items such as luxury cars', so and then you end up with a very complex GST system - which is what we've been trying to avoid."

Robin Oliver

Robin Oliver Photo: Supplied

"Desirable? No," OliverShaw expert in tax economics and policy Robin Oliver said. "It is workable, you could make this work, but you have to have a very clear boundary.

"It's not a policy I support. I don't think it's the end of the world, by the way, but the danger is the political pressure then becomes everybody of course can start offering concessions for GST to meet political moods.

"Once you take it off something, how do you stop? We also have GST on doctors fees. How do you justify that?

"Eventually, you end up with a very narrow base and if you want to collect the same amount of GST, you would have to massively increase the GST rate on everything else that you do catch. So if you halve what you're taxing you have to double the rate to collect the same amount of money."

Susan St John

Photo: RNZ / Cole Eastham-Farrelly

"It's a populist idea," Child Poverty Action Group economics spokesperson Susan St John said. "It's one that has appeal to the general public who don't really understand all the complexities of doing it.

"It's probably one of the least cost effective ways for helping people who are struggling to feed their families.

"The benefits can be shown to be appropriated largely by the higher income people because they spend more on fresh fruit and vegetables, and it doesn't necessarily change behaviour at the lower end just by making those things cheaper when people don't have enough money. If they were to have a few extra dollars in their pockets, they may not necessarily want to spend it on fresh fruit and vegetables. So it just doesn't stack up from an economics point of view.

"If what you're trying to do is to get lower income families feeding their children nutritious food, this is not the way to do it ... this is just tinkering."

Sir Robert McLeod

Sir Rob McLeod Photo: Ngatiporou.com

"We tend to describe that as a GST full of holes," businessman, professional director and Business Round Table tax specialist and former chair Sir Robert McLeod said.

"People exploit those holes either deliberately or accidentally and it does lead to less GST being collected for the tax base in the country than is otherwise achievable.

"The compliance and administration costs in tax is large, and people tend to ignore those... indeed, there are some studies that suggest that those administration and compliance costs are the biggest component of the deadweight loss of taxes, tax costs, and they go through the roof as soon as you complicate the design of the system.

"The motivation here is not tax policy, revenue, and the tax system: The motivation is to please voters. Isn't that reasonably obvious, or is that too cynical?"

Craig Macalister

Findex tax advisory partner Craig Macalister Photo: Supplied

"The basic bottom line is that removing GST just isn't a smart way of lowering food prices," Findex tax advisory partner Craig Macalister said.

"Despite the ostensibly well-meaning intentions of those pushing the idea, the simple truth is such an action lumps unwanted compliance costs on businesses and invites a visit from that old foe unintended consequences.

"GST applies to all end-user consumers of goods and services and is a great revenue-raising tax. If the government can't balance its books, there are only two options: borrow or raise taxes elsewhere.

"If we remove GST from food items, why stop there? It becomes hard for any Government to retain GST on other necessities such as toiletries or health products and the like.

"In short, while everyone sympathises on food prices, tinkering with the GST system is not a winning formula. New Zealand's GST regime is the envy of the world because of its simplicity, making revenue collection easy while limiting the cost of collection."

"fruit" - Google News

August 14, 2023 at 01:00PM

https://ift.tt/xfLauKP

Tax experts respond to GST-free fruit and vegetables: 'Populist' and 'stupid' - RNZ

"fruit" - Google News

https://ift.tt/Ro74TVr

https://ift.tt/i2Kc6uP

Bagikan Berita Ini

0 Response to "Tax experts respond to GST-free fruit and vegetables: 'Populist' and 'stupid' - RNZ"

Post a Comment